The brief

Boxopay is a company that provides FinTech services and deals with substantial user datasets daily. They required an automated KYC onboarding solution to streamline identification, screening, and user onboarding across multiple systems.

Challenge

The primary business challenge was complicated, back and forth time-consuming registration process for the user, including identity verification and document submission.

The technical part of the challenge involved creating a flexible and universal module that allows integration with external services of various types.

Solution

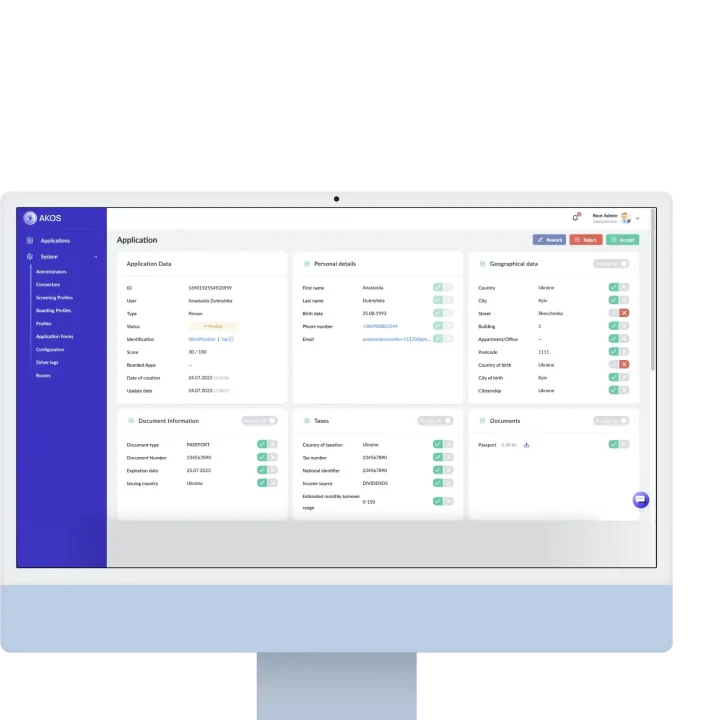

We developed an end-to-end, headless solution consisting of two panels:

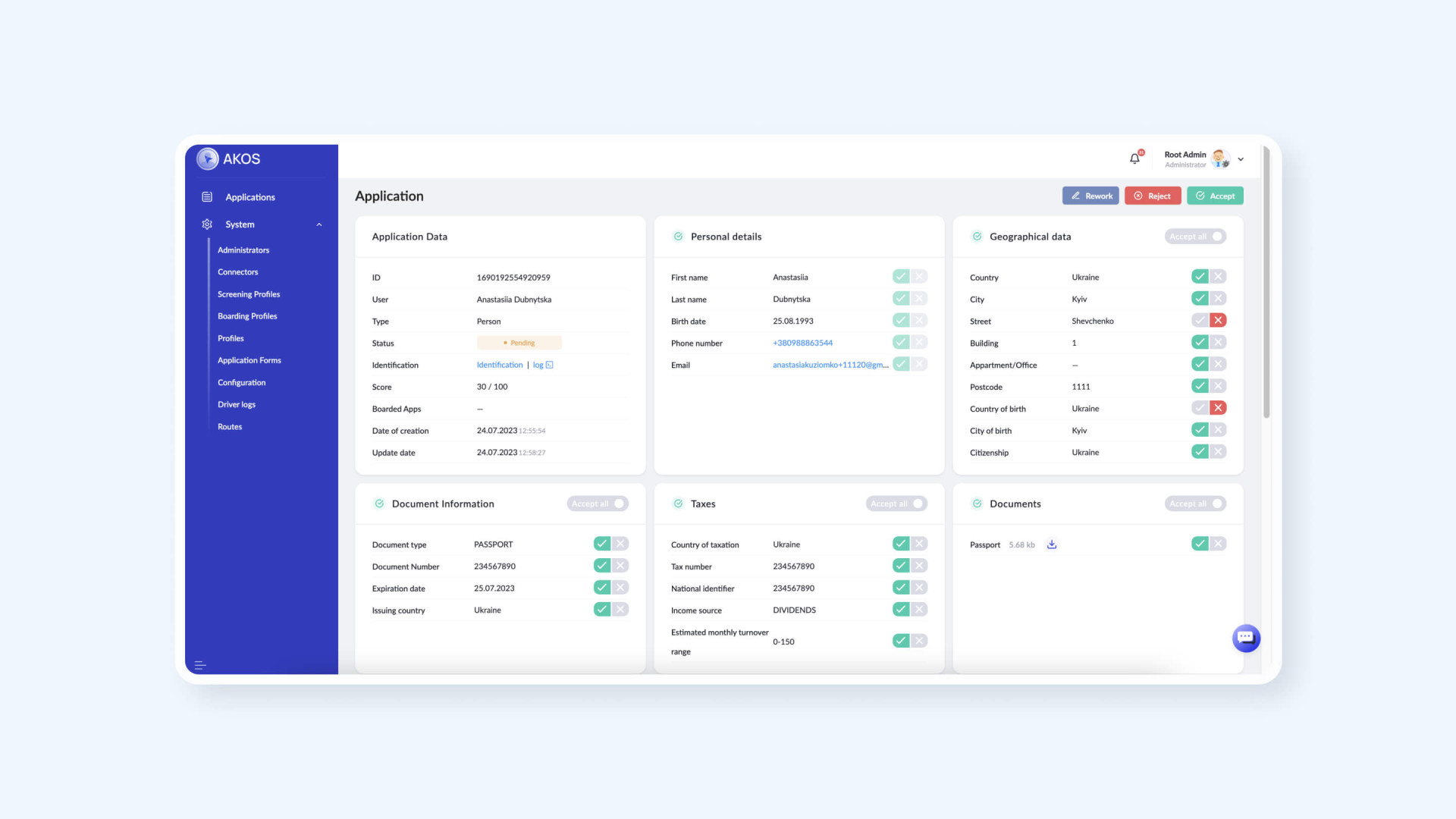

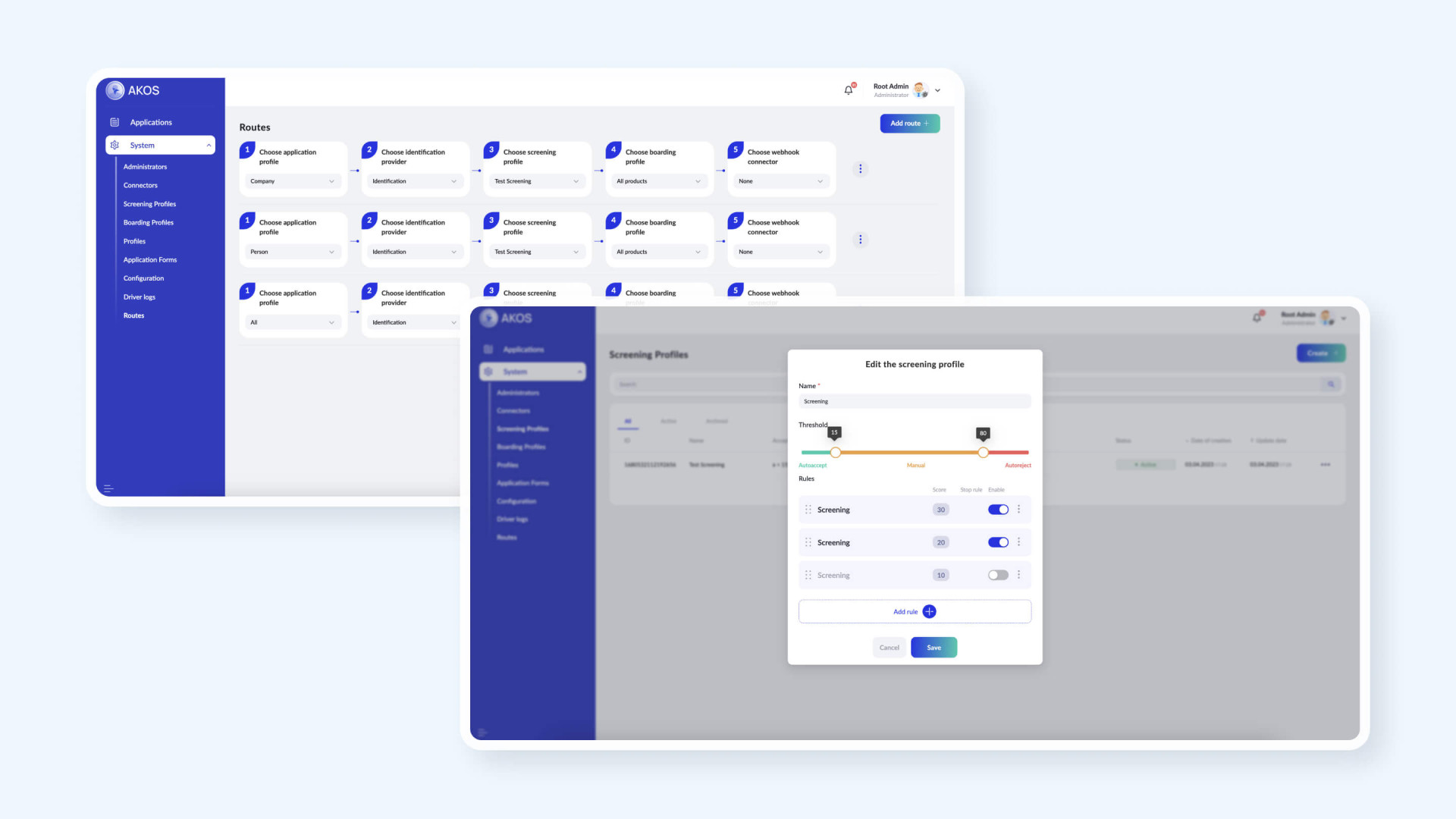

- An admin panel (admin back-office) that enables configuring both internal application processing rules and third-party services with further application management.

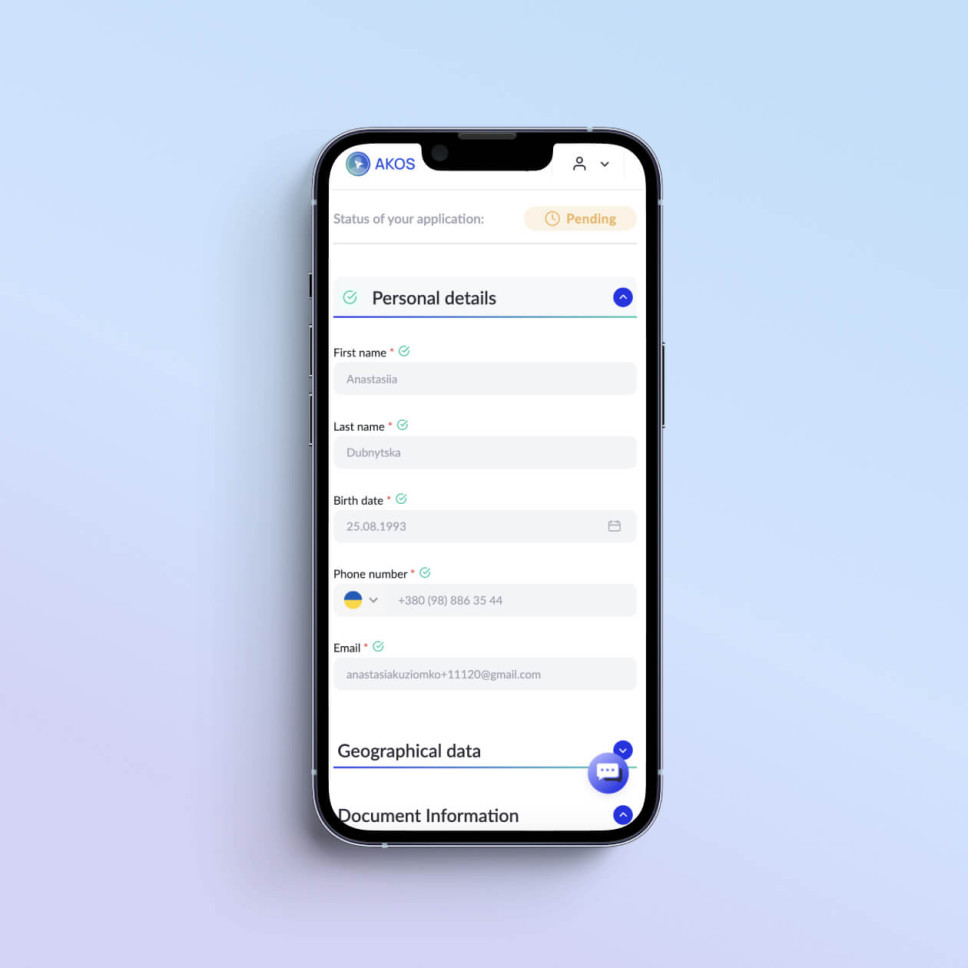

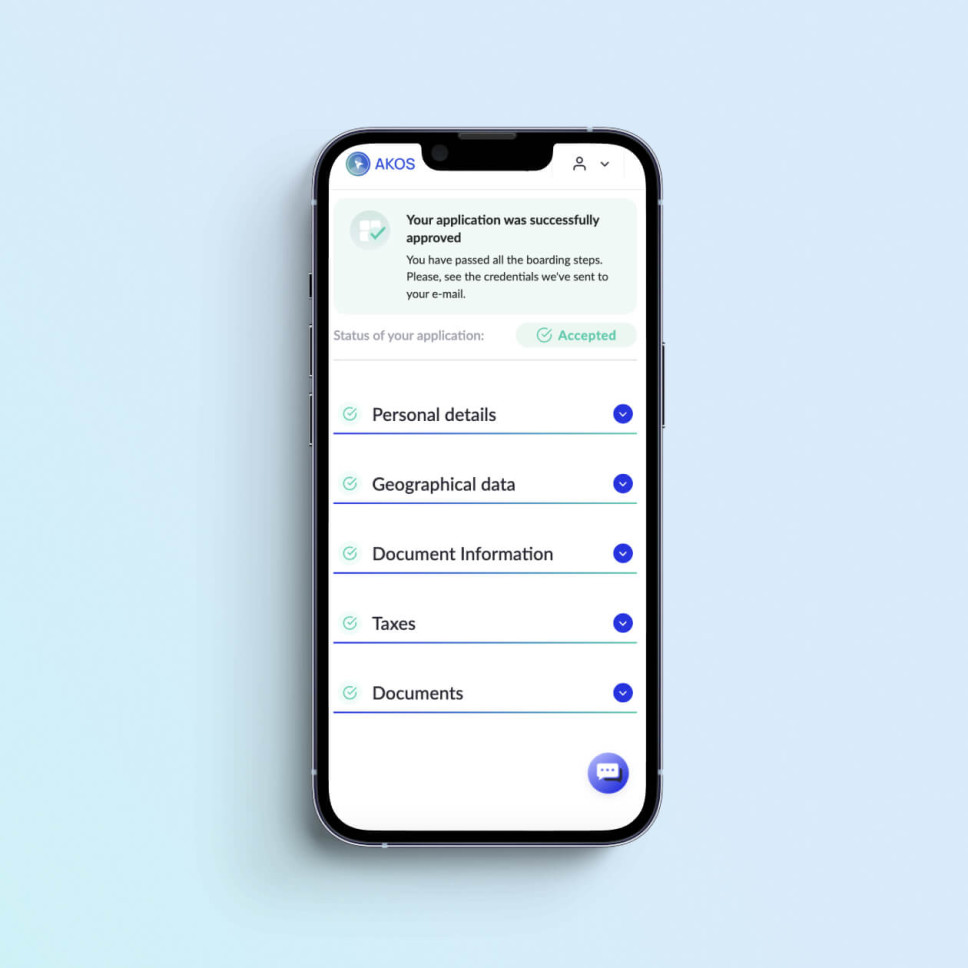

- A user panel that enables passing the stages of identification, screening, and entering additional data for successful registration across multiple systems simultaneously.

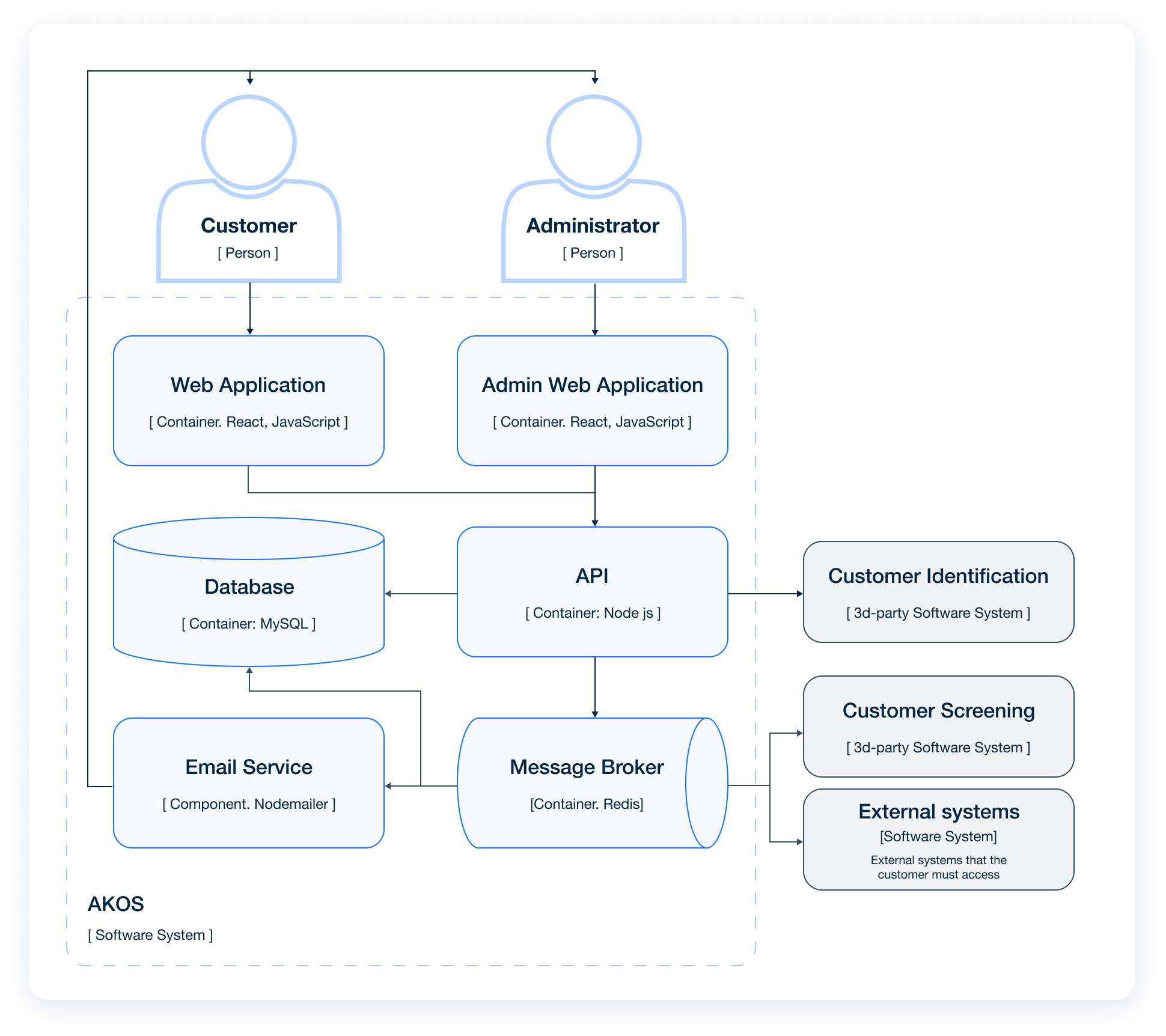

Software architecture model

Key features

We created a monolithic application with multistage queues governed by predefined rules for user identification, screening, and onboarding processes. Our solution seamlessly integrates with external services and allows for vast configurations.

User panel features:

- Registration through external links

- Application management

- Document management

- Notification management

- Communication with administrators

- Identification process completion

- Screening process completion

Admin panel features:

- Administrator management

- Application management

- Application form management

- Connector management

- Application profile management

- Product profile management

- Screening profile management

- Communication with users

Results

Our KYC Onboarding software delivers impressive metrics:

- Average onboarding time: 8.5 minutes

- Cost per onboarding: ~$10 (varies based on integrated third-party services)

- Automation rate: Up from 0 to 100%The project is currently in the delivery stage.